The buyers can take title either as:

- joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant, or

- community property with rights of survivorship, or

- community property without rights of survivorship.

Add to cart

Quitclaim Deed for Joint Ownership" />

Quitclaim Deed for Joint Ownership" />

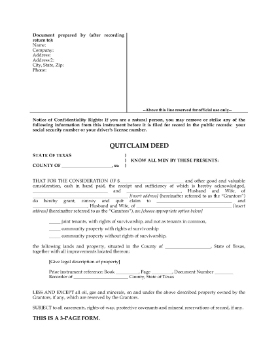

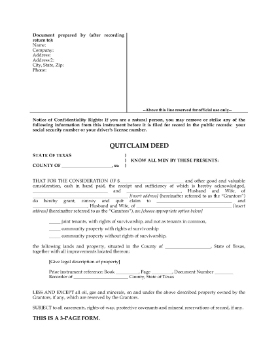

Transfer the interest in a real estate property in Texas from a husband and wife to another husband and wife with this Quitclaim Deed for Joint Ownership.

- joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant, or

- community property with rights of survivorship, or

- community property without rights of survivorship.

This Texas Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

Add to cart

Customers who bought this item also bought

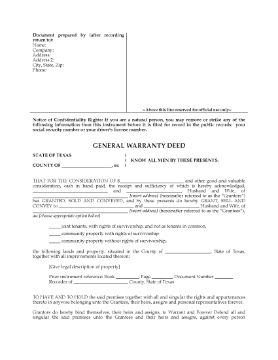

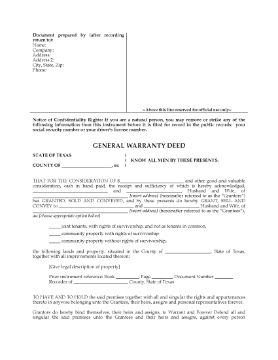

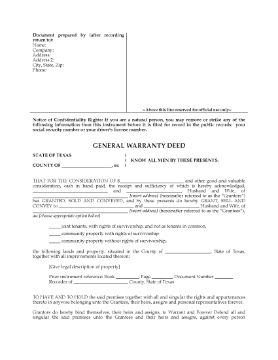

Texas General Warranty Deed for Joint Ownership

Transfer title of a real estate property in Texas from two sellers to two buyers with this Texas General Warranty Deed for joint ownership with rights of survivorship.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

- The buyers can take title either as:

- joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant, or

- community property with rights of survivorship, or

- community property without rights of survivorship.

Add to cart

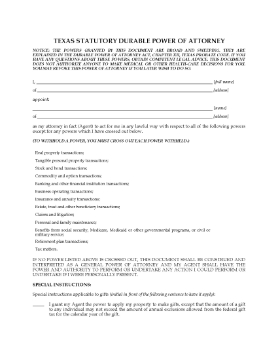

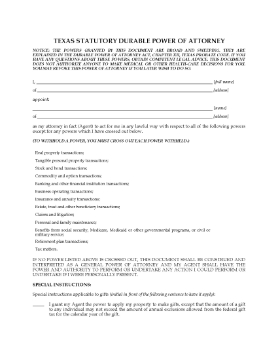

Texas Statutory Durable Power of Attorney

Make a Statutory Durable Power of Attorney with this easy-to-use form for Texas, under the Durable Power of Attorney Act, Chapter XII of the Probate Code.

- You can grant your attorney-in-fact the power to deal with your finances and property on your behalf as you see fit, including:

- your real estate property,

- banking and financial transactions,

- stocks and bonds,

- personal property,

- insurance,

- retirement plans and social security,

- employment benefits,

- tax and legal matters,

- your business affairs and operations.

Add to cart

Texas 3 Day Notice to Vacate (not for nonpayment of rent)

Serve a tenant who has violated the rental agreement with this Texas 3 Day Notice to Vacate (not for nonpayment of rent).

- The Notice must be served in accordance with the requirements of Title 8 of the Property Code.

- The tenant is notified that they have 3 days to vacate (quit) the premises.

- If the tenant does not vacate the premises, the landlord will file a forcible detainer suit to evict the tenant.

- A Service of Notice form is included, to record the details of service.

- This legal form template is available in MS Word format and is easy to download, fill in and print.

- Intended for use only in the State of Texas.

Add to cart

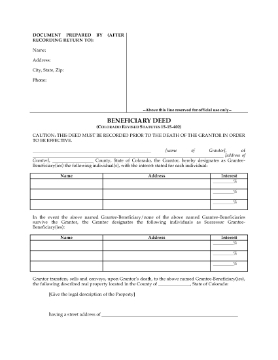

Colorado Beneficiary Deed Forms

Make sure your real estate property passes to the beneficiary you choose when you die with these Colorado Beneficiary Deed forms.

- You must complete, sign and record the beneficiary deed (also called a Transfer on Death Deed) with the County Recorder's Office during your lifetime. It cannot be recorded after your death.

- Even though the title is transferred to your beneficiary, you still retain ownership rights over the property and you can deal with it as you see fit without the consent of the beneficiary.

- You can revoke the transfer at any time by recording the enclosed Revocation of Beneficiary Deed.

- Note that in Colorado, executing a Beneficiary Deed means your home is no longer an exempt resource for Medicaid and you run the risk of losing Medicaid.

- The Colorado Beneficiary Deed Forms are downloadable MS Word templates.

Add to cart

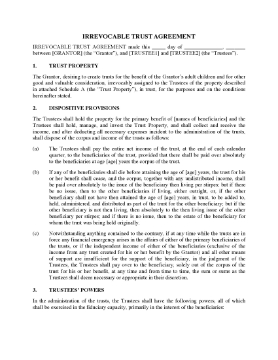

Irrevocable Trust Declaration | USA

Prepare an Irrevocable Trust Declaration to set up trusts for the benefit of a grantor's adult children with this template form for the USA.

- In the event of a beneficiary's death, the assets will be distributed per stirpes, but if the deceased beneficiary has no children, the share is distributed to the other beneficiaries.

- The net income will be distributed at the end of each calendar quarter. The body of the trust will be paid to the beneficiaries when they reach a specified age.

- The grantor cannot borrow any part of the trust property or income without adequate security and interest.

- The property or income of the trust cannot be sold for less than adequate compensation.

- This form is available in MS Word format. It can be easily customized to fit your circumstances.

- Governed by U.S. laws and intended for use only within the United States.

Quitclaim Deed for Joint Ownership" />

Quitclaim Deed for Joint Ownership" />